Dec 25, 2020 | 11 minutes

7 Easy Ways to Automate your Invoices (and Save Hours of Your Time)

Ready to automate your invoices but not sure where to begin? Check out these 7 invoice processing tasks you can automate to save countless hours of your time.

We know how much of a headache managing invoices can be. Regardless of the size or activity of your business, invoice processing is:

Time consuming: filling, sending and following up on invoices takes time

Overwhelming: invoices can quickly pile up and become challenging to manage

Expensive: how many human (billable) hours does it take just to manage invoices?

Draining: processing invoices takes away from other tasks where your energy would be much needed

As you most likely know, automation can help you with these problems. In this article, we will show you how to automate invoice processing, and what your options are.

Why should you automate your invoicing process?

Let’s start off with some simple math.

The average accounting employee is able to process 5 manual invoices per hour, at a rate of 12 minutes per invoice. This includes:

Data entry

Proofreading

Correcting

Processing the invoice

According to Glassdoor, an Accounts Payable Clerk in charge of processing these documents earns an average of $39,950/year or about $19.21/hour.

In summary: on average, each invoice costs almost $4 to process.

Automation, on the other hand, can seamlessly process dozens of invoices at a fraction of the cost.

By adding up the monthly subscription for invoicing software such as Quickbooks ($12.50/month) and an automation platform like Make ($9/month), you’d be spending the equivalent of an hour on your employee’s time.

Human interaction is of course valuable in many business areas, but invoice processing? That can be partially or thoroughly automated for increased returns on labor and capital.

On top of the financial aspect, other benefits associated with invoice automation include:

Saving time and accelerating the fulfillment process

Reducing error rates and data loss

Increasing employee productivity while reducing operational costs

Improving transparency throughout the workflow

Gathering useful data and analytics

Before we dive into specific examples of how to automate invoicing, let’s break down the two biggest invoice types.

What are the two main invoice types?

Depending on your business model, there are two ways you might issue invoices to your clients:

Before payments (accounts receivable)

After payments (receipts, and invoice copies for bookkeeping purposes)

Before payment

Sending invoices before getting paid is common among the professional services B2B industries, where invoices work as payment requests, detailing products or services that were provided.

Referred to as “accounts receivables” by the company and “accounts payable” for the client, the invoice essentially works as a payment request to be completed within a certain period of time (15 or 30 days for example).

For invoices issued before payment, automation opportunities include:

Automatically invoicing clients to accelerate the payment process

Registering invoices in your accounting software to have a clear view of the accounts receivables pipeline

Getting reminders when an invoice is due to receive the corresponding payment on time

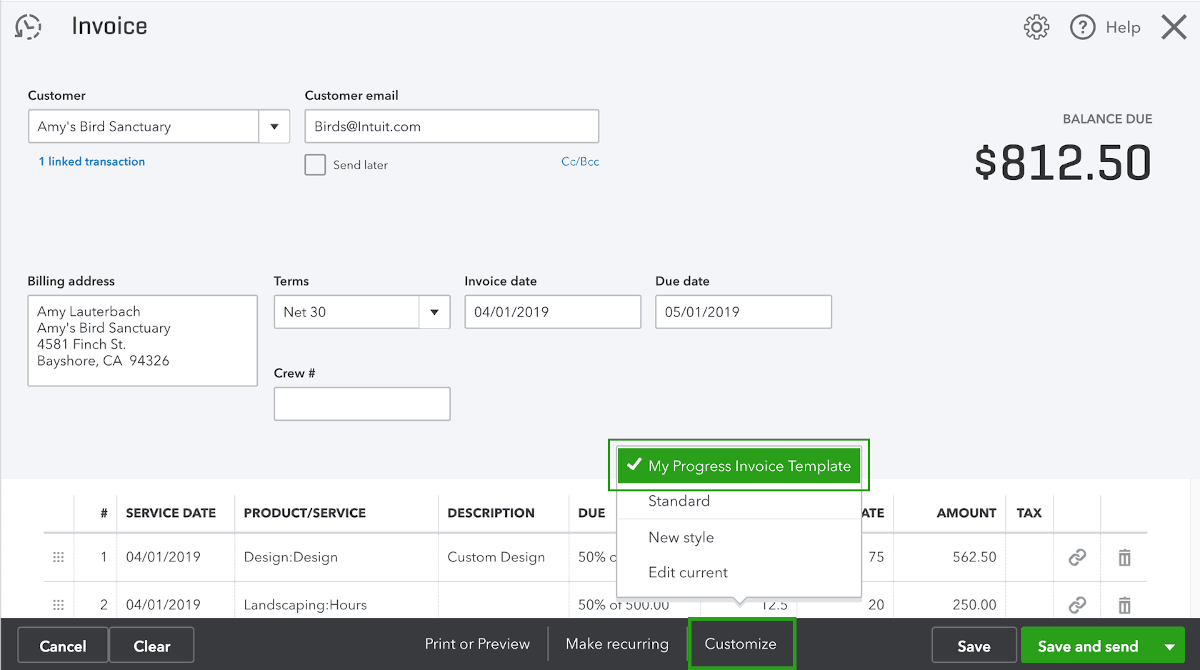

An invoice in Quickbooks

After payment

In this situation, the invoice serves as a receipt for the customer, acknowledging payment and providing proof for records keeping purposes.

This is common in ecommerce, where you receive an invoice by email after purchasing a pair of shoes for example.

Here, automation can help by:

Sending a copy of the invoice as a receipt to customers to save time

Copying invoices to your accounting software to streamline bookkeeping efforts

Automatically creating invoices from payment data to accelerate the sales process

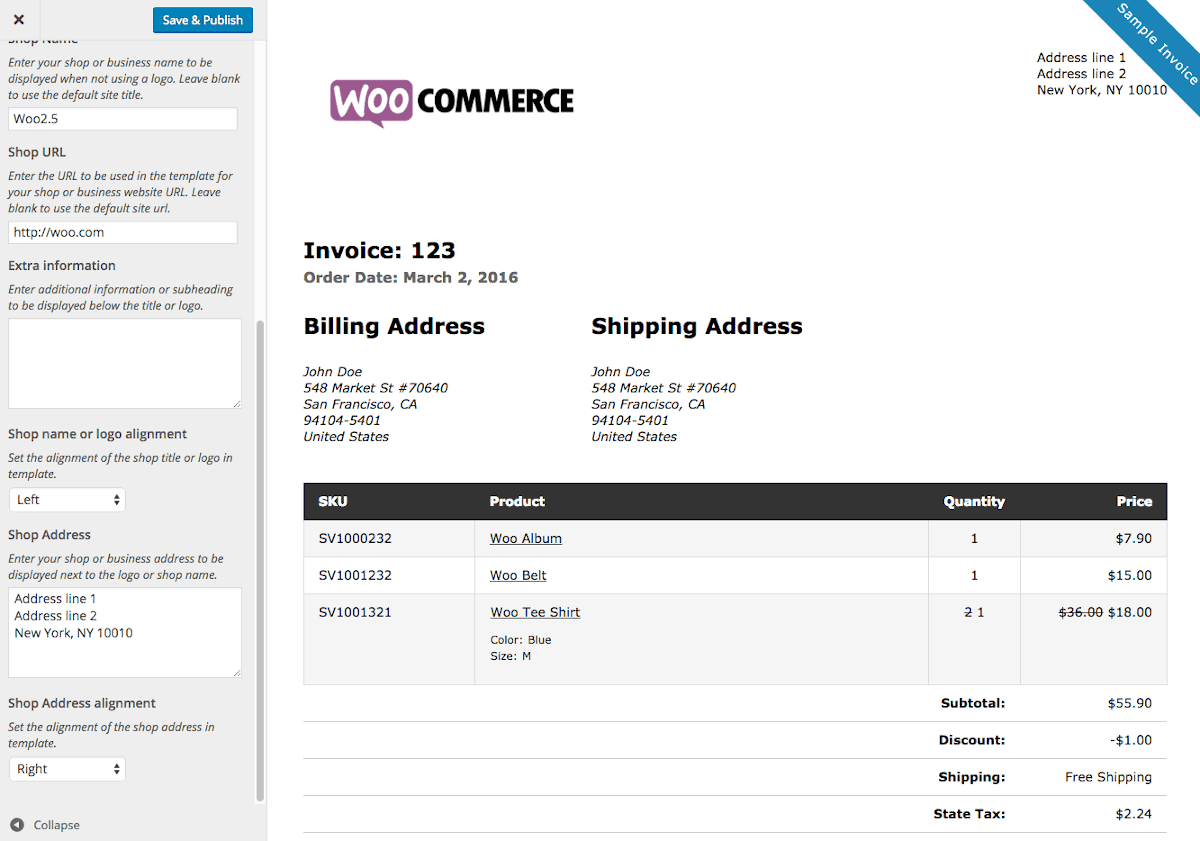

An invoice in Woocommerce

This distinction is important because it changes the focus and purpose of the invoice.

Now that this is clear, let’s take a look at seven examples of how to automate invoice processing for your business.

7 invoice processing tasks you can automate

The two main ways to automate your invoice processes are fairly straightforward. You can:

Rely on native integrations and features present in some of the apps you already use (such as Stripe, or QuickBooks)

Use a dedicated automation tool like Make

The choice of using one or the other (or the two in parallel) will depend on what makes the most sense for your business and your team.

With this in mind, we will explore seven ways to automate invoice processing for your business; some are native solutions, while others can be easily developed with Make.

1. Generate a receipt for every order in your online store

Manually generating invoices for every order that comes through your store is a repetitive and annoying task.

As mentioned earlier in the article, it ends up being a costly but also inaccurate process, which automation can help by:

Saving time and effort from your staff

Avoiding data entry errors and mistakes

Ensuring an invoice is created every single time

If you’re using an ecommerce platform for your online store, a variety of plugins are available to create invoices when an order is completed, including:

Webtoffee’s PDF invoice generator for WooCommerce

Order Printer Pro for Shopify

On the other hand, you can also create your own custom invoice solution with Make, which will automatically create invoices in your accounting system every time an order is completed.

Use this template to create an invoice in QuickBooks every time an order is completed on Shopify.

2. Use forms to automate invoice creation

For invoices that are issued before payment, forms are a great way to implement a “hands-off” process.

These forms require minimal intervention from you since all the relevant details are filled directly by the customer. On top of that, forms bring other benefits to your invoice processing workflow, including:

Consistency: forms are made of fields describing specific information, plus they are easy to map out

User-friendliness: while filling out a form is not the most fun activity out there, it’s a very simple process we’re all familiar with, and it doesn’t require any explanation

Non-technical: tools like Typeform, JotForm, and make it easy to edit a field or even change the design of your form

Inviting customers to fill out a form will help you streamline the invoice creation process without any effort.

Use this template to create an invoice in Freshbooks once a form is created in Typeform, automatically filling the invoice fields with the answers provided.

3. Automatically invoice your customers

As obvious as it may seem to send an invoice when to request payment, erring is human.

Between copying, pasting, and data entry, it’s natural that things sometimes fall through the cracks when it comes to invoicing.

As a result, there’s obvious value in ensuring that every single invoice in your system is automatically sent to your customers, conveniently crossing another pesky repetitive task off of your to-do list.

This is something that solutions like Zoho and Quickbooks can help you manage with recurring invoices so that the clients you bill every month get the corresponding invoice.

The only downside with these solutions is that they can be a bit more complicated to implement for one-off payments and irregular billing. This is where an automation tool can take over, detecting when an invoice was created in your system and sending it to the appropriate contact on file.

Use this template to automatically send invoices to the assigned contact in Zoho when they’re created.

4. For freelancers: Automatically generate an invoice including your rate at end of every month

Freelancers are often power users when it comes to invoices, as:

Clients ask for invoices in order to pay for the services provided

They usually issue invoices on a recurring basis

They deal will multiple clients simultaneously

Depending on their industry and activity, many freelance workers bill hourly rates for their work.

The process is quite straightforward, and it requires the freelancer to:

Calculate the number of hours worked

Multiply it by the hourly rate

Create the invoice

Send the invoice

As soon as clients and projects start piling up, these tasks become a chore.

With errors and delays causing a potential threat to their bottom line, it only makes sense for freelancers to automate invoice creation and make sure it’s done on time, and accurately.

Time tracking solutions such as Harvest and Toggl allow freelancers to accurately track their activity by the minute and to create invoices accordingly.

Alternatively, if you prefer to use your own invoicing software, Make can help by coupling your time-tracker with your invoicing software, generating automated, accurate invoices to send to clients.

Use this template to add Harvest entries to a Google Spreadsheet that automatically creates a Xero invoice at the end of each month. Note: For the scenario to work, make sure the contact exists in both Xero and Harvest and has the exact same name on both platforms.

5. Receive a reminder when an invoice is due

Invoices that are issued before payment are, in essence, a request to pay for a service or a product.

These come with a deadline (often within 15 or 30 days of the issue date) but clients can sometimes forget to pay on time.

Whether you’re the one issuing the invoice or required to pay it, it’s bad form to miss out on an invoice deadline, because:

It delays the payment and can trigger fees

It reflects poorly on your internal operations and management

It can negatively impact the seller/buyer relationship

To avoid the very uncomfortable moment of calling clients after an invoice is due (or receiving that call) setting a reminder can help.

Most invoicing tools (such as Quickbooks or Invoice Ninja) feature reminders and alerts that will send you an email once an invoice is due.

Alternatively, you can use Make to integrate your invoicing software with your favorite communication tool and get notified when an invoice is created or due.

Use this template to be reminded on Slack when an invoice is created on Invoice Ninja.

6. Store a copy of every invoice created in your accounting software for easy reference

One of the most important parts of creating a sound invoicing workflow is to keep a paper trail of your financial operations. This is important for several reasons:

Transparency: both your accounting department and your customers should be able to find invoices and check their status

Auditing: you have to be able to locate every financial transaction your business is conducting at all times

Getting paid: having a clear overview of your invoices is paramount to ensure all accounts receivables records are up to date

To make sure that you’re keeping tabs on all invoices, asking someone from the accounting team won’t cut it. In order to avoid this, your accounting software has to reflect the relevant information at a glance, at all times.

Platforms like Zoho Suite or Quickbooks feature a complete set of solutions allowing users to integrate everything in one place. Most accounting tools nowadays also provide integrations that allow you to sync complimentary services like Harvest and Xero.

And then there’s Make, which allows you to automatically forward data from one platform to the other, and properly store invoices in your accounting software coming from any source.

Use this template to add every invoice created in Invoice Ninja to the appropriate contact in Xero.

7. Keep a copy of invoices in a safe place

Now that you know how to copy invoices into your accounting software, it’s time to learn how to keep a copy in a different place. Why?

Your accounting software might have an issue one day, causing you to lose your records

You might want to provide access to invoices to a collaborator, without giving them the ability to access your accounting software

This is a safe thing to do and doesn’t have to take time or energy. Simply automate your workflow so every invoice created is automatically copied over to a safe folder or location.

Use this template to store new GetMyInvoices documents in Google Drive.

Bonus: Automate your whole invoicing workflow for complete autonomy

Finally, the ultimate way to automate your invoicing is to gather all your accounting and invoicing software stack and processes in one big automation.

By picking which tips and tricks in this article are right for you, you can then create a custom scenario that will bind it all together, throughout the entire fulfillment process. For example, a single automation could gather these subsequent steps:

Copy customer details in your invoicing software

Create an invoice when a payment or an order is received

Store the new invoice in a safe place and in your invoicing software

Send the invoice to the customer

Receive a reminder when the payment is due

Creating a complete automated process will take a bit of time to set up, but the benefits it will yield are worth the effort by saving you time, resources, and money.

For example, after implementing an automated process for invoicing, the consulting company Accenture has reported that their invoicing speed improved from an average of 3 days to under 10 minutes.

Moreover, their accuracy also improved, as they reduced spreadsheet data entry errors to 0%.

Conclusion

Invoices can be a headache, and one of the most volatile documents in an accounting department. They are:

Easy to lose

Easy to forget about

Hard to track

Prone to errors

By automating their creation, storage, and integration in your workflow, you’ll minimize the risks.

At the end of the day, business is about providing services and products to your customers, and getting paid while doing it. Invoices are a core element of this process, but shouldn’t get in the way.

We hope the tips in this article will help you focus on what matters most. To automation!

Ready to make the automation revolution happen?